Western sanctions is hurting Russia, no mistake on that. However what I already put in this thread for sometimes basically are:

1. Very debeatable to claim it will cripple Russian economy and Export as Western Politicians and Western Maintream media claim in the begining of this sanctions/Trade War.

In fact one of them now already talking differently:

The perverse effects of sanctions means rising fuel and food costs for the rest of the world – and fears are growing of a humanitarian catastrophe, says Larry Elliott, the Guardian’s economics editor

www.theguardian.com

Again it is still too early to really can gauge how far this sanctions will cost Russia. Still so far the data even projections from many large market players, is not going to be as much as Western leadership hopes when they first set this actions.

2. It will cost the West too. The cost is basically because both of West (especially EU) and Russia has to decoupling their economic relationship to each other. It is pure delusional when they first set this sanctions and give impression that West will only got 'small' costs to pay as many Western leadership try to downplay it.

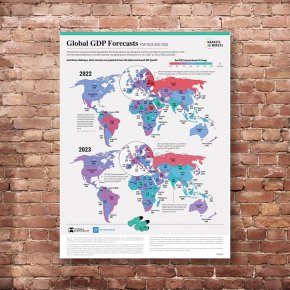

Now they begin to admitt on the media, that the costs will be substantial enough. The Projections on EU 2022 and 2023 that IMF put, actually still 'mild' projection for EU. Some in market even already calculate potential contractions (negative growth) on some in EU, if they are too hasty changing energy and commodities sources from Russia, without securing reasonable deals from other suppliers.

This happen because everyone still climb back from COVID recession. Everything still fragile, thus this sanctions just hammering recovery process. If you put too much costs to your still recovering economies, the reverse effect will happen.

3. Still unless this War escalating toward direct NATO and Russia confrontations (as some hawkish politicians in West wants), this economic adjustment will be happen mostly in 2022-23 only. Moody's projection when this war happen already predict that. Most us in the market still believe that (including my self).

However what will come out after 2023 adjustment, will not be Business as ussual. China possition will be strengthen, thanks on this as one of the factor. This because many emerging market outside collective west increase their 'hedge' toward non western market. We can see even rich gulf kingdoms basically push back US and EU pressure to increase the hydrocarbon productions more as their demand.

This is personally I believe due to rising options on other 'polarity' outside US lead system. Some of them going to see they can 'spread' their global connectivities outside US lead influence only. Basically they become more assertive toward US and West.

Actually the trend already shown before this war, even before Covid. This war just fasten it. Like I put in this thread, some Western market players already warn US and EU leadership on the costs of 'weaponised' financial market system. Those system should be relatively

neutral toward all market users. This to ensure the continuation of high level of confidence toward the system.

Playing with that, will increase 'untrust' factor especially from non Western users. This will increase chances of other 'option', which China is one of main benefactors on this. Something China already work hard to get, and now seems US increase that chances to China.

US and Collective West will still be major players and factors on Global Economy and Financial market. However the other options will potentially come out faster then predicted before.